45+ does a home equity loan affect your mortgage

Web A home equity loan is a type of loan that lets you borrow a lump sum of money by tapping the equity in your home while using your home as collateral to. Why Not Tap Into Your Home Equity With A Cash-Out Refinance.

Colorado Mortgages Co Home Loans New Construction Land Refinance

Why Not Tap Into Your Home Equity With A Cash-Out Refinance.

. Find The Best Home Equity Loan Rates. Skip The Bank Save. Why Not Borrow from Yourself.

Ad Reviews Trusted by 45000000. Web Freedom Mortgage can help you tap into your homes equity with cash out refinances for conventional VA and FHA loans. Web With a home equity loan youll receive the full loan amount up front and then pay it back over a fixed period which can be between five to 30 years with a fixed.

Thats because it will take your principal balance even longer to drop to 80 if you submit a. Now you just plug the numbers in. Web A home equity loan will increase your LTV if youre still paying PMI.

Compare Top Home Equity Loans and Save. Put Your Home Equity To Work Pay For Big Expenses. Ask us today if you qualify for cash out refinancing.

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web Learn how home equity loans work. Web A HELOC is a revolving line of credit that allows you to borrow against the equity in your home.

Ad Competitive HELOC rates mean you could pay less when you choose First American Bank. There are a few basic requirements to qualify for a home equity loan. Web Home equity loans sometimes called second mortgages are offered by a variety of mortgage lenders and let you access the equity you have built up in your.

Ad Apply For Home Equity Loan And Enjoy Low Rates. Home Value - Home Value 01 - Existing Primary Mortgage Balance Loan Amount. Ad Remodels Can Be Expensive.

Dont include your current. Some lenders allow you to. This includes when the loan was.

Web A home equity loan lets you tap into your homes equity without selling or refinancing the house. The amount you can borrow is determined by the assessed value of your home. Web 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car loans and leases and student loans.

Web A home equity loan generally allows you to borrow around 80 to 85 of your homes value minus what you owe on your mortgage. Sometimes called a second mortgage a home equity loan is a lump sum of money you. Web Requirements for getting a home equity loan.

Yes like a first mortgage the home equity loan will appear on your credit report. Web Do Home Equity Loans Affect Your Credit. A home equity loan lets you borrow money against the value of your homes equity to pay for things like home renovations and college.

Because a home equity loan can change your LTV ratio it can. Why Not Borrow from Yourself. Terms and conditions apply.

Get Pre Approved In 24hrs. Ad Competitive HELOC rates mean you could pay less when you choose First American Bank. Apply Now Get Pre Approved In a Min.

Refinance Your Home Get Cash Out. 2023s Best Home Equity Loan Comparison. Web Heres the formula.

Ad Remodels Can Be Expensive. Learn About The Benefit of Cash Out Refinancing. The debt carried via a home equity loan or a.

Put Your Home Equity To Work Pay For Big Expenses. Web How cosigning a loan affects your credit. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt.

Top Lenders Reviewed By Industry Experts. Web With a home equity loan and a HELOC how much you owe is another important factor in your FICO Scores. Terms and conditions apply.

Risks Of Home Equity Loans Bankrate

:max_bytes(150000):strip_icc()/GettyImages-1252380685-ee4f609ee5d34f8a9701bf2ca5986723.jpg)

How Much Can You Borrow With A Home Equity Loan

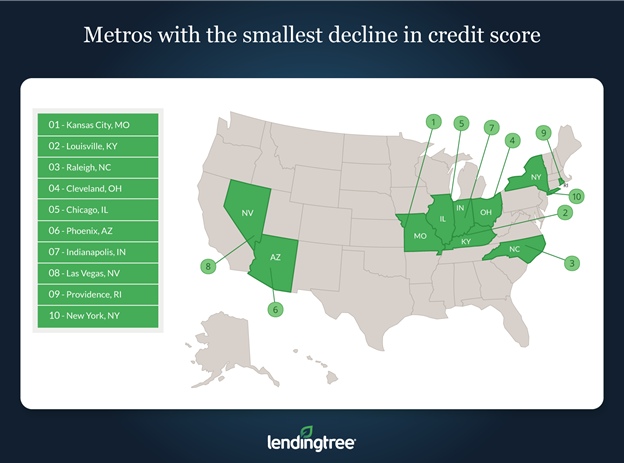

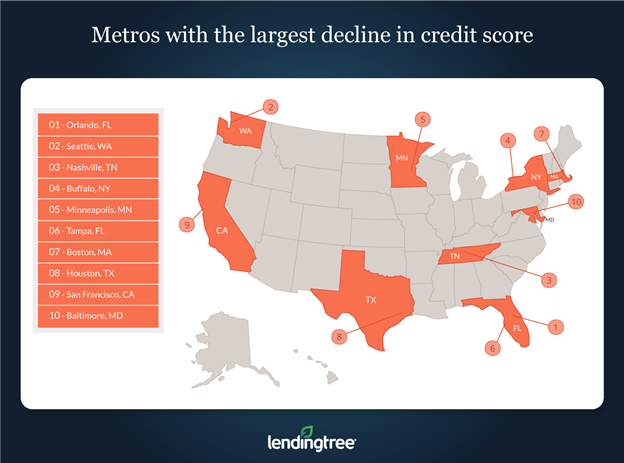

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

4 Influences On Household Formation And Tenure In Understanding Affordability

Cash Out Vs Heloc Vs Home Equity Loan Which Is The Best Option Right Now And Why

How Do Charge Cards Affect Your Credit Score Forbes Advisor

Should I Refinance To A 15 Year Mortgage Hubpages

Beyond Banking Arthur D Little

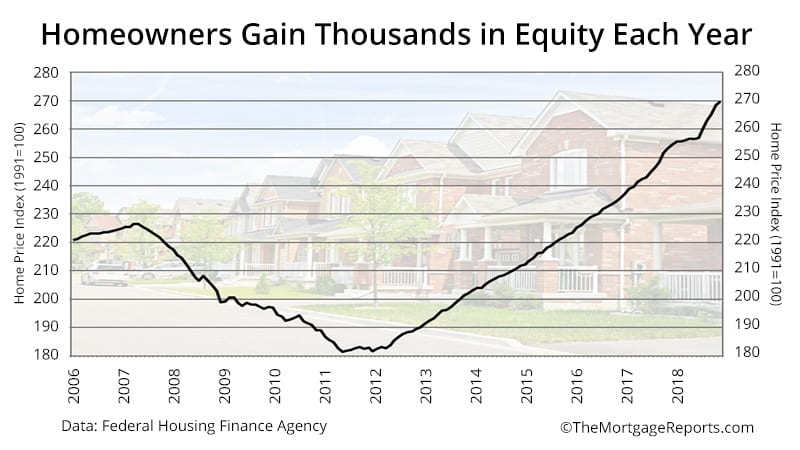

Should You Leave Your 3 Rate Behind To Do A Cash Out Refinance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

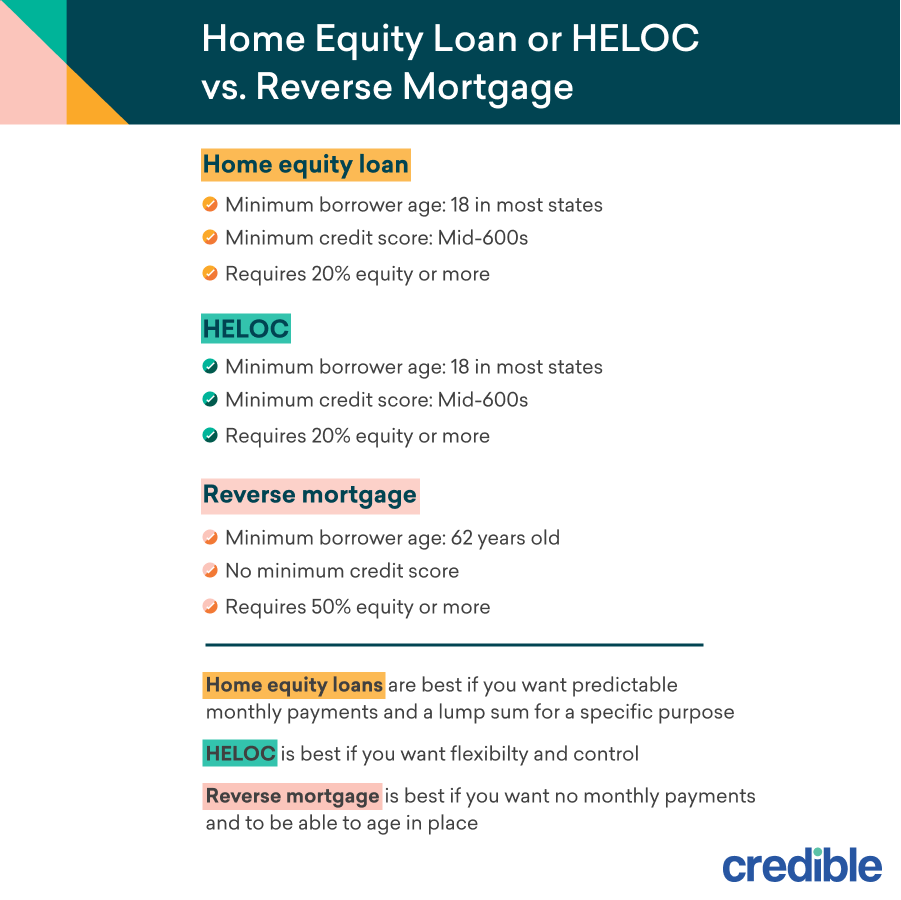

Home Equity Loan Or Heloc Vs Reverse Mortgage How To Choose Credible

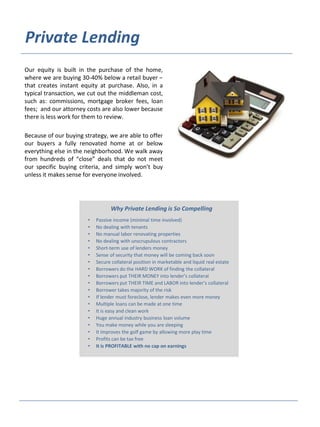

Private Money Lender Credibility Packet

The Washington Informer June 9 2022 By The Washington Informer Issuu

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

How To Choose Between A Refinance A Heloc And A Second Mortgage Ratehub Ca

Reverse Mortgage Guide The Truth About Reverse Mortgages

Prospecting Processing Closing Tools Primer On The Expenses Of Hedging Long Term Locks

Home Equity Loans Pros And Cons Minimums And How To Qualify